Jack Welch, the former chairman and CEO of General Electric (GE) increased the value of the company by over 4 000% during his time at the helm of GE between 1981 and 2001.

By Chris Blair, CEO, and Bryden Morton, executive director of 21st Century

At the time, one of Welch’s most prolific focuses was to maximise total shareholder return. This seeks to maximise the benefit received by shareholders which drives up demand for the shares and hence increases the value of the shares.

Through executing this strategy, Welch was named by Fortune Magazine as the “Manager of the Century” in 1999. Fast forward 10 years and in 2009 Welch was quoted as saying that “shareholder value is the dumbest idea in the world”.

This may seem counter intuitive given the strategy he pursued when leading GE, however Welch did have his reasons. After saying that, Welch added that “Shareholder value is a result, not a strategy. Your main constituencies are your employees, your customers and your products.” (Financial Times).

In the mid-1990s the idea of pursuing the Triple Bottom Line in business began to gain traction. The Triple Bottom Line (TBL) means Profit, People and Planet or Economic, Social and Environment. This framework was designed so that a larger group of stakeholders are included rather than the limited stakeholders using traditional financial metrics – which formed the focus of the business.

By considering each of the TBL stakeholders with equal attention, businesses are geared towards sustainability from a much broader perspective than simply economic. The importance of an organisations’ employees as well as their environmental impact has been viewed with increasing importance in recent years and has placed even further emphasis on the concept of targeting the triple bottom line.

An element which has a large bearing on an organisations financial well-being is its salary and wage bill. The remuneration strategy of an organisation needs to be in line with the goals of the business to drive the desired performance.

When considering an organisations salary and wage bill, one of the most commonly spoken of terms is that of the wage gap. The wage gap compares the pay of the CEO to that of the median general staff employee.

This calculation has often led to criticism of the CEOs pay relative to the rest of the organisation. However, the structure of the organisation can often lead to a distortion of the median employees pay level. For example, mines will have higher portion of workers at lower grades than IT companies.

For this reason, an alternative view of analysing CEO pay against organisational performance is needed to determine whether a CEOs pay is justified or not.

21st Century has created a Sustainable Remuneration Index which tracks the position of JSE listed CEOs performance under the pillars of profit, people and planet. Statistical analysis was used to determine the most significant sub-indices used to create the index for each pillar (profit, people and planet). An equal weight was assigned to each pillar’s index.

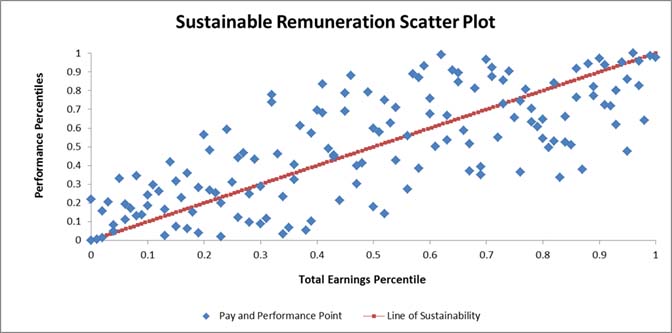

These indexes are then combined into a single figure and are percentile ranked (from lowest to highest) against the percentile rank of each company’s CEO’s total remuneration or total earnings. In other words, each company’s percentile rank of their performance and CEO pay forms a set of coordinates which are plotted on a graph.

The graph shows the scatter plot of these coordinates (pay and performance point) for each company in the sample.

Each dot represents where a company’s performance coordinate and total remuneration or total earnings coordinate intersect. The thick red line is the Line of Sustainability which would be the case if each company’s two coordinates were identical. For example: 70th percentile performance and 70th percentile pay.

The further away from the line of sustainability the less sustainable is the relationship between pay and performance.

An example of this is that a high performing CEO that is paid low may be lured away by another business. Conversely, an overpaid, under performing CEO may not have his remuneration approved by the shareholders at their annual general meeting.

By comparing themselves against the sample group, this index provides an alternative way for an organisation to determine whether their CEOs remuneration is in line with his/her performance under the pillars of the triple bottom line.

Tracking their position relative to the line of sustainability will provide companies guidance regarding their current state as well as what they need to do in future to improve.

From a societal point of view, as the scatter plot in the graph becomes more concentrated around the Line of Sustainability, the macroeconomic environment as a whole will also improve as the link between pay and performance becomes stronger than it currently is.

This will not only seek to raise business’ awareness of pursuing the Triple Bottom Line but will also reign in unwarranted, excessive CEO pay if it exists.